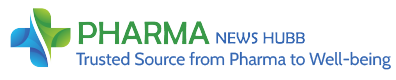

The standards, rules, guidelines, and industry-specific requirements for financial reporting. Revenues accounts are credited when the company earns a fee (or sells merchandise) regardless of whether cash is received at the time. Since a check is written, we know that one of the accounts involved is Cash.

Accounting Basics

Examples include historical cost, revenue recognition, full disclosure, materiality, and consistency. The accounting information helps the management to plan its future Car Dealership Accounting activities by preparing budgets in respect of sales, production, expenses, cash, etc. Accounting helps in the coordination of various activities in different departments by providing financial details of each department. The Government is interested in the financial statements of business enterprise on account of taxation, labour and corporate laws.

Accounting Is the Language of Business

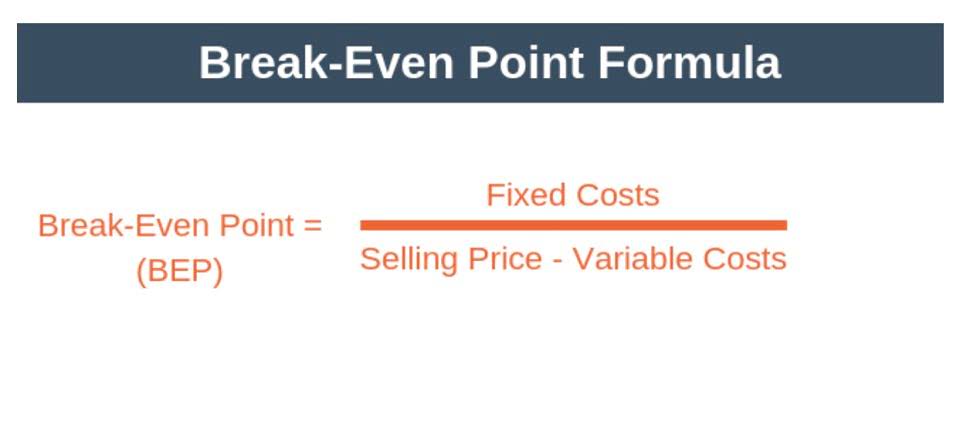

Learning to manage finances, whether in a personal or business context, is an incomparable skill. Simply put, learning accounting is understanding how to manage financial transactions. At first, learning it might seem like a daunting fixed assets mountain to climb, but it’s a journey well worth it. Similar to other processes and strategies across your business, I’m of the opinion that constantly reviewing and evaluating your accounting methods is also essential.

- This institute created many of the systems by which accountants practice today.

- The justification is that no lender or investor will be misled by a one-time expense of $200 instead of say $40 per year for five years.

- Accounting helps you gauge where your small business stands financially, what it can afford at any given time, and where its money is coming from and going.

- These frameworks dictate how transactions should be recorded and reported, ensuring transparency for stakeholders.

- Accounting is more than just reporting income to taxing authorities or providing revenue and expense information to potential investors.

Principle of Permanence of Methods

- Only through these financial statements can a company’s management make informed decisions about how to properly allocate resources to projects, by directing how to spend or invest the company’s money.

- Since the time when Joe bought them, however, the wholesale price of boxes has been cut by 40% and at today’s price he could purchase them for $0.60 each.

- Assets are things that a company owns and are sometimes referred to as the resources of the company.

- The amount in the Supplies Expense account reports the amounts of supplies that were used during the time interval indicated in the heading of the income statement.

- This is the practice of recording and reporting financial transactions and cash flows.

- In short, although accounting information plays a significant role in reducing uncertainty within an organization, it also provides financial data for persons outside the company.

For example, the year-to-date net income at May 31, 2025 for a calendar year company is the net income from January 1, 2025 until May 31, 2025. For a company with a fiscal year beginning on July 1, 2024 the year-to-date net income at May 31, 2025 is the net income for the 11-month period from July 1, 2024 through May 31, 2025. Often this is interest and dividends earned on a company’s investment in stocks and bonds of other companies. (Some corporations have preferred stock in addition to their common stock.) Shares of common stock provide evidence of ownership in a corporation. Holders of common stock elect the corporation’s directors and share in the distribution of profits of the company via dividends. If the corporation were to liquidate, the secured lenders would be paid first, followed by unsecured lenders, preferred stockholders (if any), and lastly the common stockholders.

Join 41,000+ Fellow Sales Professionals

She states that accounting software will allow for the electronic recording, storing, and retrieval of those many transactions. Accounting software will permit Joe to generate the financial statements and other reports that he will need for running his business. Accounting software allows you to do basic tasks such as tracking inventory, invoicing and payments, and generating reports on sales and expenses. It’s useful for small businesses and freelancers who don’t have the resources to hire an accountant or bookkeeper.

Corporate Reporting (CR) Course

For instance, inventory should be valued on the basis of ‘least of the cost and market price’ as per the principle of conservatism. Accounting information is not without personal influence or bias of the accountant. In measuring income, accountant has a choice between different methods of inventory valuation, deprecation accounting basics methods, treatment of capital and revenue items etc.

What is Efficiency Audit? Objectives, Purpose, Scope, Report

Tax accounting involves maintaining and keeping track of your business’ taxes. This can include filing yearly taxes, tracking spending and tax rates, as well as assisting employees with setting up tax forms. Inventory refers to the assets my company holds with the intention of selling them through our operations. This includes not only the finished goods ready for sale but also items currently being produced and the raw materials or components used in the production process. Essentially, inventory encompasses everything from the materials we start with to the final products we aim to sell to customers. The chart of accounts is something that can be used as a master list of all the accounts in my organization‘s general ledger.

Balance Sheets: My Quick-Start Guide

Because the company owes someone the money for its purchase, we say it has an obligation or liability to pay. The most likely liability account involved in business obligations is Accounts Payable. Again, reporting revenues when they are earned results from the basic accounting principle known as the revenue recognition principle. Marilyn tells Joe that accounting’s “transaction approach” is useful, reliable, and informative.